Streamline Your Payment Process

With Urable and Square

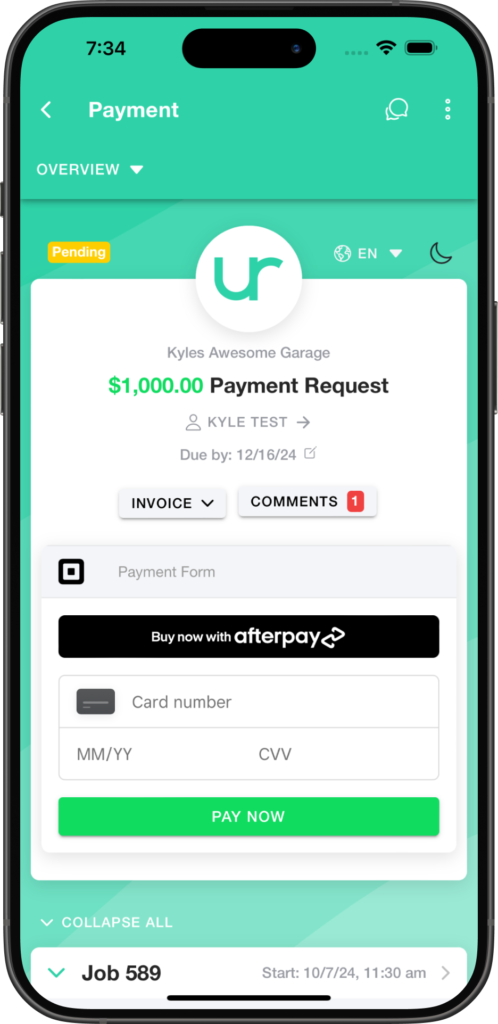

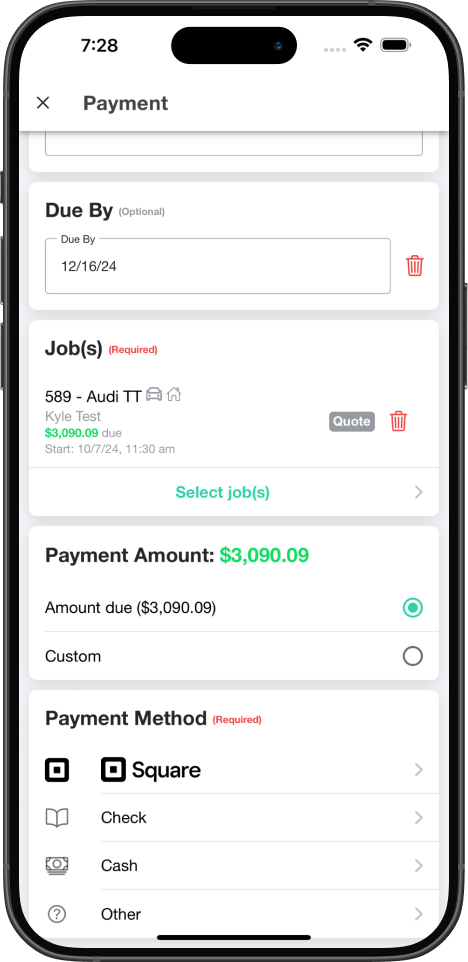

Effortlessly manage your business transactions, whether in advance or in person, by connecting your Urable account to Square. This integration allows you to accept payments from customers through multiple methods, providing a seamless experience for both parties. Say goodbye to complicated processes and hello to smooth sailing with Urable & Square.

Enhanced Customer Satisfaction Through Integrated Payments

In today’s fast-paced world, it is essential for businesses to have a strong connection with their customers. A key aspect of this is the ability to effectively manage and process payments. With the integration of Urable and Square, businesses can now provide a seamless payment experience for their customers while also simplifying their own processes.

Whether it is through online transactions or in-person purchases, Urable and Square work together to offer multiple payment options that cater to the diverse needs of customers. This not only enhances customer satisfaction but also allows businesses to stay ahead of the competition by providing a convenient and efficient payment solution.

Benefits of Using Square for Your Business

If you don’t already have a Square account…

US: https://squareup.com/i/

CA: https://squareup.com/i/

AU: https://squareup.com/i/

UK: https://squareup.com/i/

Ease and Convenience

Square offers unparalleled benefits for businesses of all sizes. With our extensive experience in handling millions of payments daily, we are experts in the field and work directly with multiple networks and acquirers on your behalf. This means you can rely on us to ensure a steady cash flow for your business.

Show more »

Compliance is a Top Priority

One of the biggest concerns for any business when it comes to payments is compliance. As the merchant of record, Square takes this responsibility seriously and is dedicated to protecting both sellers and customers. We make it easy for you by taking care of PCI Compliance, as well as conducting necessary AML and KYC checks within our system at no extra cost.

Data Protection is Key

At Square, data security is of utmost importance. That’s why we use end-to-end encryption to ensure that customer payment data never touches your servers or devices, providing an extra layer of security for your business. Our system undergoes rigorous testing 24/7 to eliminate any potential vulnerabilities, giving you peace of mind.

Safeguarding Transactions

In addition to ensuring compliance and data security, Square also minimizes your payment risk. With our $65B ecosystem of payments and a dedicated in-house team of data scientists and risk analysts, we are constantly staying ahead of fraud to protect your business. Best of all, this protection is included in your rate with no extra fees.

Hide text »

Frequently Asked Questions

What are the transaction fees for using Square?

Square charges a processing rate for each transaction. For the most current pricing information, please visit Square’s website. It is important to note that Urable does not charge any additional processing fees for transactions.

What cards can I accept with POS? Does the fee I pay vary by card?

You can accept every major card – Visa, Mastercard, American Express, and Discover – all for the same rate. Therefore, you do not have to worry about any differences in fees based on the type of card your customer chooses to use when making a purchase with your point-of-sale (POS) system.

How long does it take to get started with Square's Point of Sale?

Setting up your business to accept credit card payments on Square is quick and easy. Within just a few short minutes, you can have all of your items set up and ready to go, allowing you to take advantage of Square’s full range of products designed to help you efficiently run and grow your business.

Is there a cost for each of my employees to use Square Point of Sale?

No, you can have an unlimited number of employees using basic POS features for free with Team Management. For more advanced employee controls, there is a per location fee. So, you can easily manage your team and their access without incurring additional costs. This not only saves you money but also provides convenience and flexibility in managing your business operations.

Still have questions? Let’s talk!

Book a demo or reach out via live chat to learn more.

Once you’ve become part of the community, you’ll also have access to the team through the built-in Help Center.